child tax credit payment schedule 2021

The payments will be paid via direct deposit or check. Six payments of the Child Tax Credit were and are due this year.

Child Tax Credit Dates Here S The Entire 2021 Schedule Money

The Child Tax Credit provides monthly payments to families even those who do not file taxes or earn an income.

. Wait 10 working days from the payment date to contact us. After which the first six months will be. The schedule of payments moving forward is as follows.

Each payment will be up to 300 for each qualifying child. The schedule of payments moving forward is as follows. Disbursement of advance Child Tax Credit payments.

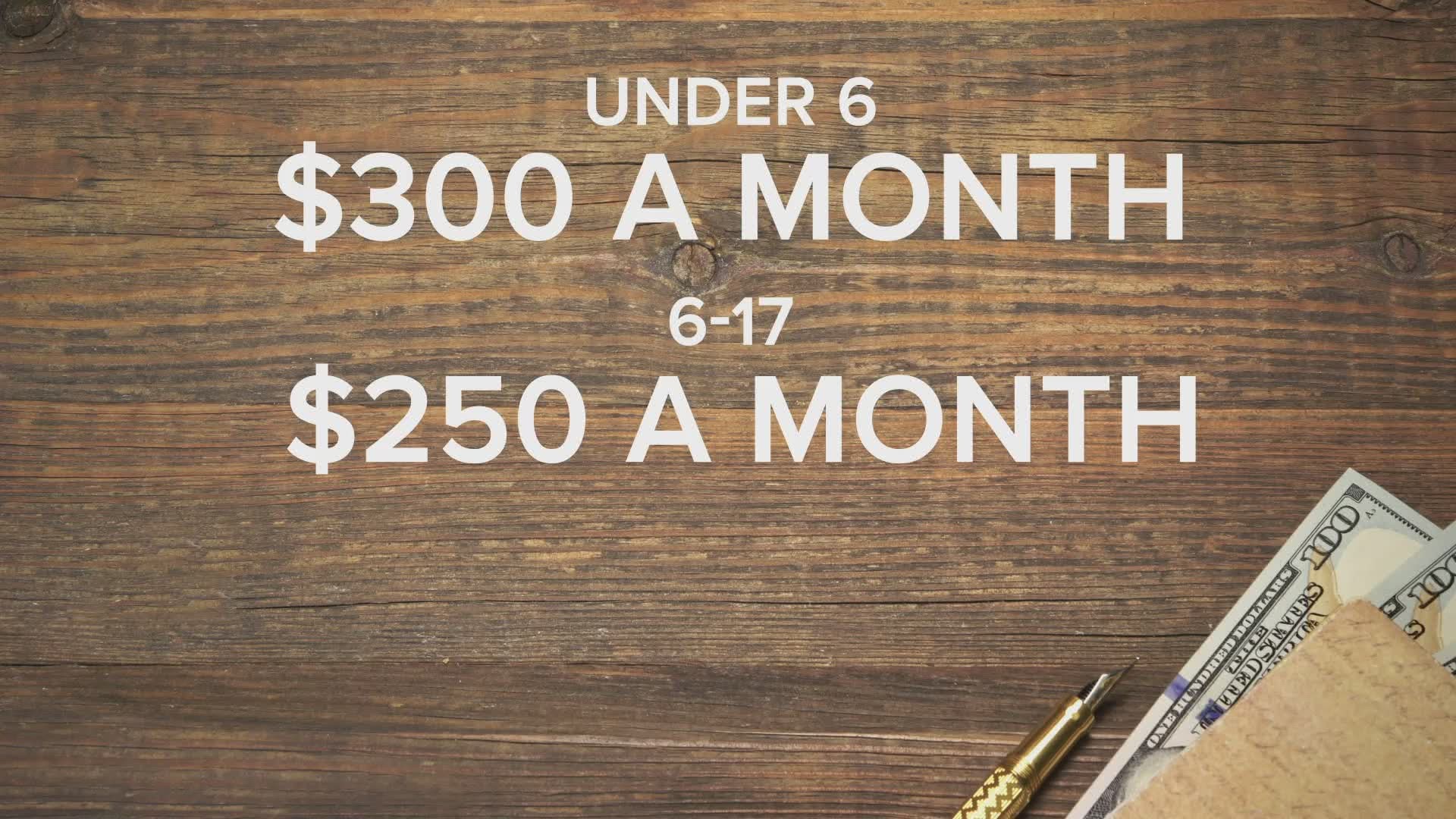

1 day agoTo use the service you must have an adjusted gross income of 73000 or less. 2021 Advance Child Tax Credit Payments start July 15 2021 Eligible families can receive advance payments of up to 300 per month for each child under age 6 and up to 250 per. Each payment will be up to 300 for each qualifying child.

Because of the COVID-19 pandemic the CTC was expanded under the American Rescue Plan of 2021. The payments will be paid via direct deposit or check. Each payment will be up to 300 for each qualifying child.

Unemployment Exclusion Update for married taxpayers living in a community property state -- 24-MAY-2021. Each payment will be up to 300 for each qualifying child. Determine if you are eligible and how to get paid.

13 opt out by Aug. IR-2021-153 July 15 2021 The Internal Revenue Service and the Treasury Department announced today that millions of American families have started receiving. 15 opt out by Aug.

How much of the Child Tax Credit can I claim on. Each payment will be up to 300 for each qualifying child. The payments will be paid via direct deposit or check.

Form 1040 1040-SR or 1040-NR line 3a Qualified dividends -- 06-APR-2021. For tax year 2021 the Child Tax Credit increased from 2000. The payments will be paid via direct deposit or check.

All payment dates. You will receive either 250 or 300 depending on the age of. The percentage depends on your income.

For more information about the Credit for Other Dependents see the instructions for Schedule 8812 Form 1040 PDF. Even if you had 0 in income you could have received advance Child Tax Credit payments if you were eligible. The default payment schedule for the new tax child care credit is for families to receive monthly payments until the end of 2021.

Under the American Rescue Plan Act of 2021 we sent advance Child Tax Credit payments of up to half the 2021 Child Tax Credit to. What is the schedule for 2021. The IRS pre-paid half the total credit amount in monthly payments from.

The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. The schedule of payments moving forward is as follows. October 5 2022 Havent received your payment.

The payment for the Empire State child credit is anywhere from 25 to 100 of the amount of the credit you received for 2021. The complete 2021 child tax credit payments schedule. The payment for the.

Recipients can claim up to 1800 per child under six this year split into the six. Frequently asked questions about the 2021 Child Tax Credit and Advance Child Tax Credit Payments Topic C. The payments will be paid via direct deposit or check.

Advance Child Tax Credit Payments in 2021. The schedule of payments moving forward will be as follows. Additionally ChildTaxCreditgov lets individuals and families file a 2021 tax return to get the.

Child Tax Credit December 2021 How To Track Your Payment Marca

First Monthly Child Tax Credit Payment Hits Bank Accounts Next Week

Liberty Tax Here S A Breakdown Of What To Expect With The 2021 Child Tax Credit Payment Schedule Sidenote If You Have A Baby In 2021 Your Newborn Will Count Toward The

Child Tax Credit 2021 What To Know About New Advance Payments

Irs Sends Millions Letters About The Monthly Child Tax Credit Payments Forbes Advisor

Using The Child Tax Credit To Boost Your Banking

About The 2021 Expanded Child Tax Credit Payment Program

Child Tax Credit Checks These Are The Dates The Irs Plans To Send Payments Rochesterfirst

Irs Announced Monthly Child Tax Credit Payments To Start July 15 Forbes Advisor

Why Opting Out Of Monthly Child Tax Credit Payments May Work For Some Families Boyer Ritter Llc

Child Tax Credits Causing Confusion As Filing Season Begins

December Child Tax Credit Date Here S When To Expect 1 800 Stimulus Check

Federal Reserve Banks Share Information About Advance Child Tax Credit Payments

Child Tax Credit Letters From Irs Showing Up In Mailboxes King5 Com

Will You Have To Repay The Advanced Child Tax Credit Payments Wkbn Com

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

Last Day To Unenroll In July Advanced Child Tax Credit Payment

Members 1st Federal Credit Union Eligible Families Have Begun Receiving Monthly Child Tax Credit Payments And They Will Continue To Be Issued Through December 2021 View The Irs Payment Schedule